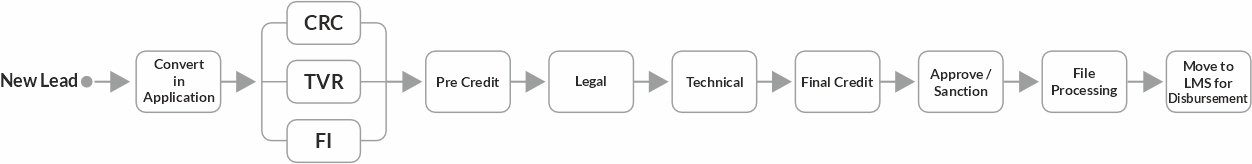

Discover the progression of lending automation through our advanced loan origination system.

Sales Executive / DSA Mobile App

- eKYC: Aadhaar, PAN, DL, etc.

- Customer De-duping (Customer Duplication check)

- Bureau Check thru api

- Loan Application capture

- Co-Borrowers

- Guarantors

- Assets

- Document Capture as per LOD

- Scheme Selection

- Multiple Products

- Field Investigation

Customer Mobile App

- Video KYC: Adhaar, PAN, Photo match, Location check, Video call

- Bureau Check thru api

- Loan Application capture

- Co-Borrowers

- Guarantors

- Assets

- Document Capture as per LOD

- Scheme Selection

- SMS Capture

- Contacts Capture

- Multiple Products

- Payment of Charges

- Sanction Letter

- Loan Agreement

- eSign on Loan Agreement

- Pay EMI

- OTP based Login

- Repayment Schedule

- Interest Certificate

- Statement

- Product Definition

- Flowchart based Workflows

- Task Work-center

- Email System Integrated into Loan Application

- Credit Appraisal

- Sanction Letter

- Loan Agreement

- eDisbursal